LUSP Trust

A retirement plan and a savings plan in one, the LUSP Trust Plan provides a financial safety net for your family’s future. Unlike 401(k)s and mutual funds, which are exposed to wide stock market fluctuations, LUSP invests in an array of fixed-income securities. With the Plan’s focus on mortgages, government securities, high grade corporate bonds, and the like, you can be confident that your account value is secure and will not vary with market conditions.

Of course, there are other major life events to save for—you might want to buy a home or pay for a college education, after all—and LUSP provides a safe, guaranteed plan. With LUSP:

Plan your future with confidence with LUSP Trust. Retire with dignity. Join thousands of others who have put their trust in our trust, and enroll to secure your bright future!

You can contribute to the fund in any increment. Verizon employees with payroll deduction may contribute in increments of $7. You may also make lump sum deposits of $500 or more, with no limit. If your employer allows, you can contribute periodically via direct deposit as well. Additionally, contributions can be made via Bill Pay, check, or payroll deduction.

Interest earned on contributions is accumulated on a tax-deferred basis. This means that no taxes are due until money is withdrawn. Contributions to the plan are not tax deductible.

You may take a full withdrawal at any time and a partial withdrawal once every 12 months*. There is no requirement to take a distribution from the plan after you leave employment. In addition, because the plan is non-qualified, you are not required to take withdrawals when you reach 70½. You may leave your deposits with the plan as long as you like.

Participants may elect to purchase an annuity. Participants should consult with our Plan Advisor before making these decisions.

Participants may designate beneficiaries to receive their account balance in the event of the participant’s death. Beneficiaries have the right to take the entire account subject to current tax laws on the taxable portion. They may also leave the account in the Trust and change the name on the account to their own. Beneficiaries may also elect to take the account in the form of an annuity.

Contributions and earnings (principal and interest) are guaranteed by Nationwide Life Insurance Company, the funding agent. Nationwide manages the plan’s assets, which are commingled in a single fixed-income group annuity investment portfolio. The Fund is not guaranteed by the FDIC, NCUA or any federal or state agency.

*A $50 fee applies for a full distribution; a $25 fee applies for a partial distribution which cannot exceed 60% of the account balance. On withdrawals made by individuals not yet 59½ years old, a 10% excise tax imposed by the IRS may apply.

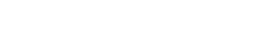

LUSP is a non-qualified trust fund, which provides the opportunity to save for retirement and other major life events in a secure, fixed-income plan. The interest rate is set annually for the coming year.

LUSP Trust was founded in 1974, at a time when many organizations in the U.S. were creating vehicles to supplement company pensions for employees. Its goal was to provide a sound savings plan for members. In the decades since, LUSP Trust has helped thousands of employees and their families secure a brighter future.

The fund is governed by a Board of Trustees and managed by the Chairman of the Trust and the Plan Administrator.

Ready to secure your future?

Ready to secure your future?

Our Specialists are available to answer your questions and assist you in joining the LUSP Trust. Call or email today!